Prediction Markets: Key Policy Issues, Risks and Opportunities to Watch in 2026

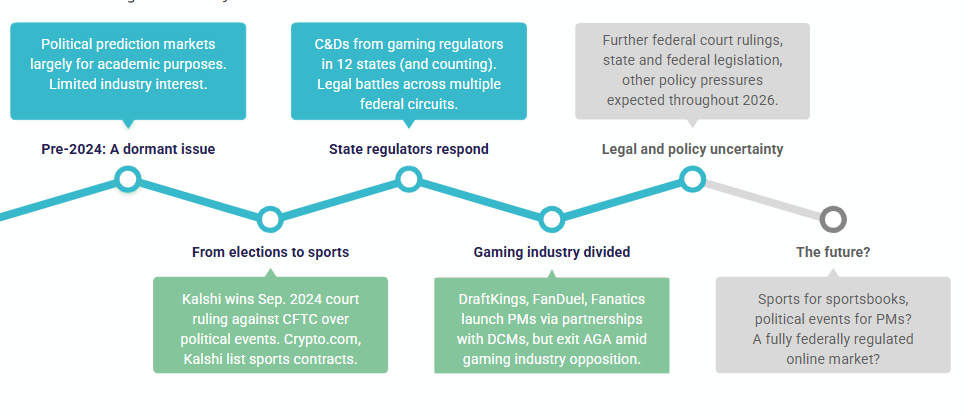

Request a DemoPrediction markets have been in sharp focus for all stakeholders in the US gaming industry ever since early 2025 when Kalshi and Crypto.com launched sports event contracts under the guise of federally-regulated derivative exchanges. While this has triggered a multistate and high-stakes legal battle, it has also opened a potential new pathway for sports betting expansion that does not involve state-by-state licensing, regulation and tax. At the same time, Polymarket has risen to prominence internationally - drawing the attention of global regulators, industry groups and the media.

Using takeaways from our exclusive Prediction Markets Breakfast Briefing we hosted at last week’s ICE - which featured an expert panel including Robert B. Stoddard, Lead US Tax Partner at KPMG, Jeremy Kleiman, Member, Saiber Law and our own Principal Analyst, Zachary Birnbaum and Chief Analyst, James Kilsby - we share some perspectives on the key policy issues to watch in 2026 and debate the risks and opportunities presented by the burgeoning prediction market space in the US - and beyond.

Prediction Markets: Key Policy Issues to Watch in 2026

If 2025 was the year prediction markets burst into the mainstream, 2026 is the year governments and regulators begin to react in earnest. Three policy fronts are especially important to monitor:

1. The unfolding multi‑state litigation landscape

More than a dozen US states have already taken action against prediction market platforms, including Kalshi, Crypto.com, Robinhood and Polymarket . Multiple federal cases are now moving through different circuits – the 9th, 4th, and Massachusetts cases arguably being among the most consequential as things stand. Because these cases raise similar questions about federal preemption, self‑certification, and whether sports outcomes can legally be treated as “event contracts,” many expect the issue to ultimately be resolved by the US Supreme Court.

But with an eventual Supreme Court ruling unlikely before 2027 or even 2028, operators face a prolonged period of uncertainty. Over the next year, new injunctions, state enforcement activity, and divergent rulings are likely to make the legal landscape even messier.

2. Legislative interest in Congress – but focused on integrity, not prohibition

While a full federal overhaul is unlikely in 2026, lawmakers from both parties - but especially Democrats - are starting to signal concern about market manipulation, under‑21 access, responsible gambling, and political betting. The NCAA, in particular, is lobbying aggressively around student‑athlete protection. Any congressional action in 2026 is as likely to focus on safeguards an an outright ban on sports event contracts – but whether there is a pathway for any federal legislation in an election year is far from assured. One key issue to watch is how federal and state lawmakers respond to election betting being promoted aggressively by prediction market platforms in an increasingly competitive environment.

3. International regulators shifting attention to prediction markets

Outside the US, the dominant concern is not sports betting circumvention, but political integrity and AML/KYC risk. Polymarket, in particular, is now on the radar of regulators in Europe, Latin America , and elsewhere. Some jurisdictions s are already taking action: for example, Romania and Portgual recently blocked specific political event contracts because they were offering speculative markets on elections. With elections set to take place in October, Brazil seems set to emerge as an increasingly prominent prediction market battleground over the coming months.

The global conversation is now expanding rapidly and could influence how prediction markets evolve as a cross‑border product class.

Prediction Markets Opportunities for Operators and Suppliers

Despite the turmoil, prediction markets offer an enticing opportunity for operators and suppliers willing to accept the regulatory uncertainties.

1. Faster, lower‑friction national access

Because prediction markets operate under federal CFTC rules, they offer something sportsbooks have long dreamed of: 50‑state scale without 50‑state licensing. While this status may ultimately change, the current environment allows digital‑first operators to enter new markets more quickly and at considerably lower cost than traditional sports betting.

2. A new way to acquire customers in non‑betting states

Much of the early volume in sports event contracts has come from California and Texas—states that have not legalized sports betting. Prediction markets allow operators to reach these audiences under pre-existing federal rules, creating a powerful acquisition funnel ahead of any future sports betting legalization.

3. Attractive economics and lighter regulatory burdens

Prediction markets currently enjoy:

- Prediction markets regulated under the CFTC are not subject to state gambling duties or sports betting tax regimes, at least under the current legal environment

- Lower compliance overhead relative to the obligations placed on state‑licensed sportsbooks

- Self‑certification of event markets, instead of having permitted wagering events determined by state gambling regulators

- Minimal restrictions on advertising in contrast to rules enforced in most sports betting states

- Lower age thresholds (18+ compared to 21+ in most sports betting states)

For operators, these factors create a materially lower cost base than regulated sports betting. For B2B suppliers—payments, identity, geolocation, odds, data—this opens a new customer segment in a high-volume market.

4. Product innovation and audience engagement

Prediction markets let operators go beyond traditional point spreads and moneylines, with the ability to offer wagers or trades on events that are off-limits in state-regulated sports betting. For example:

- Political risk markets

- Entertainment and cultural event markets

- Financial or weather‑based contracts

- Novel forms of real‑time market‑driven engagement

One question for 2026 is how far prediction markets are willing to push the envelope, and whether event contracts even start to replicate casino-style games similar to certain forms of gaming machines in the land-based U.S. market.

Risks: Where the Pressure Will Come From

The growth of prediction markets also brings existential risks—especially for operators straddling both regulated gambling and unregulated prediction market environments.

1. Insider trading and market manipulation

From athlete trades to political events and even geopolitics, prediction markets invite integrity risks far beyond those seen in traditional sports betting. A high‑profile scandal could trigger swift political backlash.

2. Underage gambling and collegiate issues

Because prediction markets are available to 18–21‑year‑olds, regulators fear an explosion of integrity breaches and youth gambling harms.

3. State regulator retaliation

Some states—Michigan being a notable example—have already taken the position that licensees’ out‑of‑state behaviour matters. Licensed operators and suppliers supporting or offering prediction markets in one state could conceivably ace repercussions for their gaming licences in another.

4. International political concerns

Election‑related markets are already under scrutiny globally. Countries are increasingly worried about foreign influence, crypto‑based activity, and bets on sensitive political outcomes.

Practical Steps for Operators and Suppliers

1. Apply sports‑betting‑grade internal controls even where not required.

Age gating, RG tools, integrity monitoring and potentially geofencing will help maintain greater credibility with regulators.

2. Avoid offering sports event contracts in states where you hold a sports betting licence.

This has become the industry norm for licensed sportsbook operators, at least for now and it may avert regulatory conflict.

3. Prepare for a volatile legal environment.

Operators should assume that new injunctions and cease-and-desist orders may restrict activity state by state throughout 2026.

4. Monitor global developments.

International scrutiny is accelerating, especially around political markets and crypto‑funded activity.

Want to know more?

Vixio's gambling compliance platform has an entire hub dedicated to U.S. prediction markets, which consolidates our expert insights, research, regulatory updates and data to provide you with a full view of one of the most closely watched areas of the global gambling industry.

.gif)

Book a demo to see how the Vixio platform can help you track, asses, analyse and action regulatory change in this area and more.

Request a demo

Insights and intelligence for some of the world’s biggest brands

What our clients say

.svg)